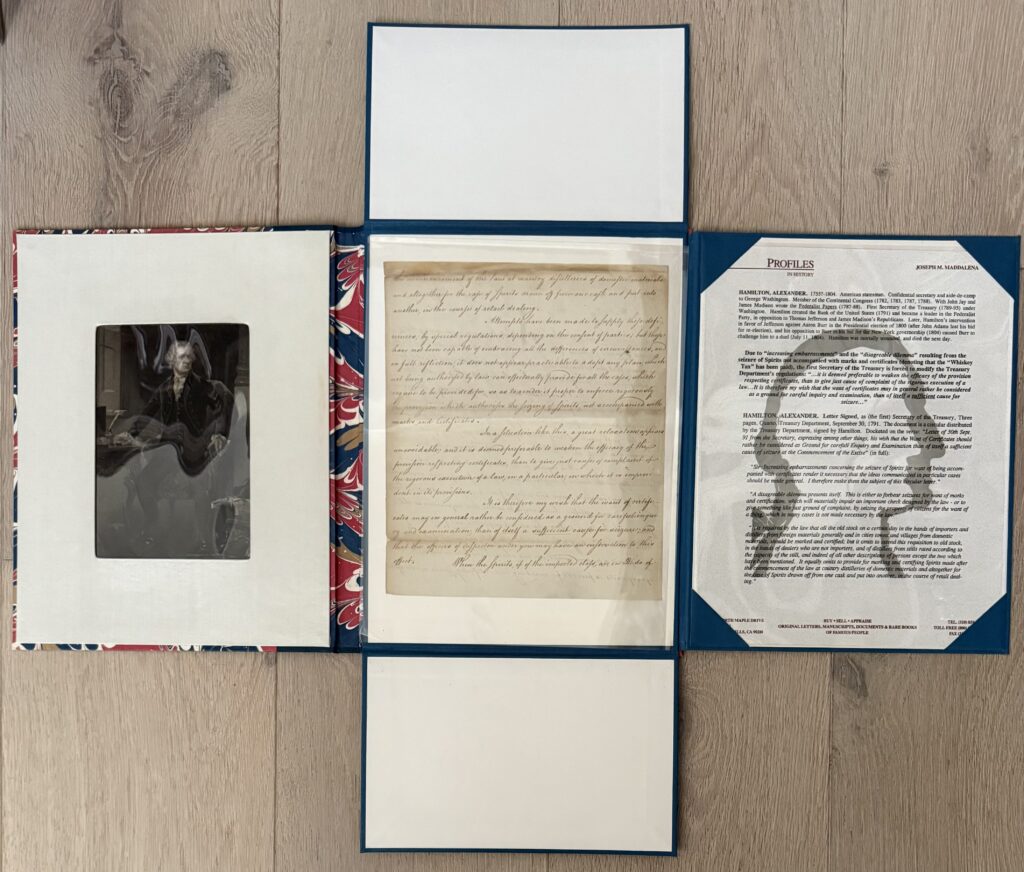

AS SECRETARY OF THE TREASURY OF A NEW NATION, ALEXANDER HAMILTON DEALS WITH TARIFFS ON WHISKY

ALEXANDER HAMILTON. Letter Signed, as the first Secretary of the Treasury, Three pages Quarto, Treasury Department, September 30, 1791. This document is a circular distributed by the Treasury Department, signed by Hamilton. Docketed on the verso, “Letter from 30 Sept 91 from the Secretary, expressing, among other things, his wish that the Want of Certificates should rather be considered as Ground for careful Enquiry and Examination than of itself a sufficient cause of seizure at the Commencement of the Excise” in full:

“sir Increasing embarrassments concerning the seizure of Spirits for want of being accompanied with certificates render it necessary that the ideas communicated in particular cases should be made general. I therefore make them the subject of this circular letter.

A disagreeable dilemma presents itself. This is either to forbear seizure for want of marks and certification, which will materially impair an important check designed by law-or to give something like just ground of complaint, by seizing property of citizens for want of a thing,which in many cases is not made necessary by the law.

It is by the law that all the old stock on a certain day in the hands of importers and distillers from foreign materials generally and in cities towns and villages from domestic materials, should be marked as certified; but it omits to extend this requisition to old stock, in the hand of dealers who are not importers,and of distillers from stills rated according to the capacity of the still, and indeed of all other descriptions of persons except the two which have been mentioned. It equally omits to provide for marking and certifying Spirits made after the commencement of the law at country distilleries of domestic materials and altogether for the case of Spirits drawn off from one cask and put into another, in the course of retail dealing.

Attempts have been made to supply these deficiencies; by special regulations, depending on the consent of parties; but these have not been capable of embracing all the differences of circumstances, and on full reflection, it does not appear practicable to adopt any plan, which no being authorized by law, can effectually provide for all the cases which require to be provided for, so as to render it proper to enforce rigorously the provision which authorizes the seizing of Spirits, not accompanied with marks and certificates.”

“In a situation like this, a great relaxation appears unavoidable; and it is deemed preferable to weaken the efficacy of the provision respecting certificates, than to give just cause of complaint of the rigorous execution of a law, in a particular, in which it is improvident in its provisions.”

“It is therefore my wish that the want of certificates may in general rather be considered as a ground for careful inquiry, and examination, than of itself a sufficient cause for seizure; and that the officers of inspection under you may have an instruction to this effect.”

“When the Spirits, if of the imported class, are in Hhds (Hogsheads – large barrels or casks} of upwards of an hundred gallons, or, from any evident marks, in the original packages in which they are imported, or when they can be traced to have been brought from any distillery of foreign materials, or of domestic materials in a city town of village, in every such case the presumption of fraud from the want of certificates will be strong enough to justify a seizure – But it ought to be impressed upon all concerned, that great circumspection is to be used, in every instance, in making a seizure, on the mere score of want of marks and certifications. With great consideration I am, Sir, Your obed. Servant A. Hamilton”

During President George Washington’s first term in office, the chief issue was the. fiscal program, devised by his Secretary of the Treasury, Alexander Hamilton, to deal with the debt inherited from the Confederation, an excise tax on the manufacture of distilled liqueurs, and a national bank. Hamilton’s second report on the public credit, dated December 13, 1790, recommended an excise tax (known as the Whisky Tax) an the manufacture of spirits as a means of supplementing revenue yielded by the tariff.

As Hamilton details in this lengthy circular, the tax was not meant to be imposed on “old stock in the hands of dealers who are not importers” or small time distillers: it was meant to be imposed on importers and distillers from foreign materials. When put into effect the levy had imposed a heavy burden on backwoods farmers for whom distilling was a chief mode of disposing of surplus grain, and had aroused great discontent throughout the new nation.

In the face of such opposition, and as a result of the “embarrassing” problems related to the wholesale seizure of spirits not bearing marks or accompanied by certificates, Treasury Secretary Hamilton is forced to modify the regulations previously issued. He recommends a more methodical and careful examination of spirits not marked or accompanied by certificates.

A fascinating Treasury document dating from Hamilton’s tenure as Secretary of the Treasury, when he was called upon to devise, create and exicute a bold and complete fiscal system for the new government of a new nation.