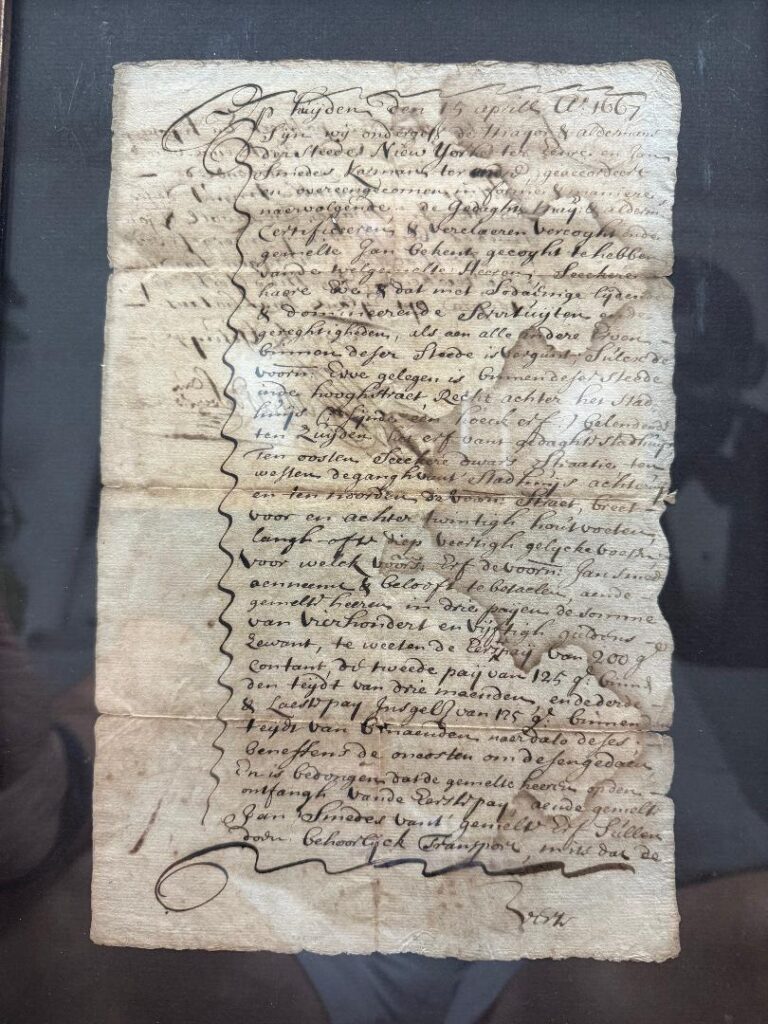

ORIGINAL LAND DEED FOR 85 BROAD STREET IN NEW YORK CITY DATED 1667, LATER TO BECOME GOLDMAN SACHS.

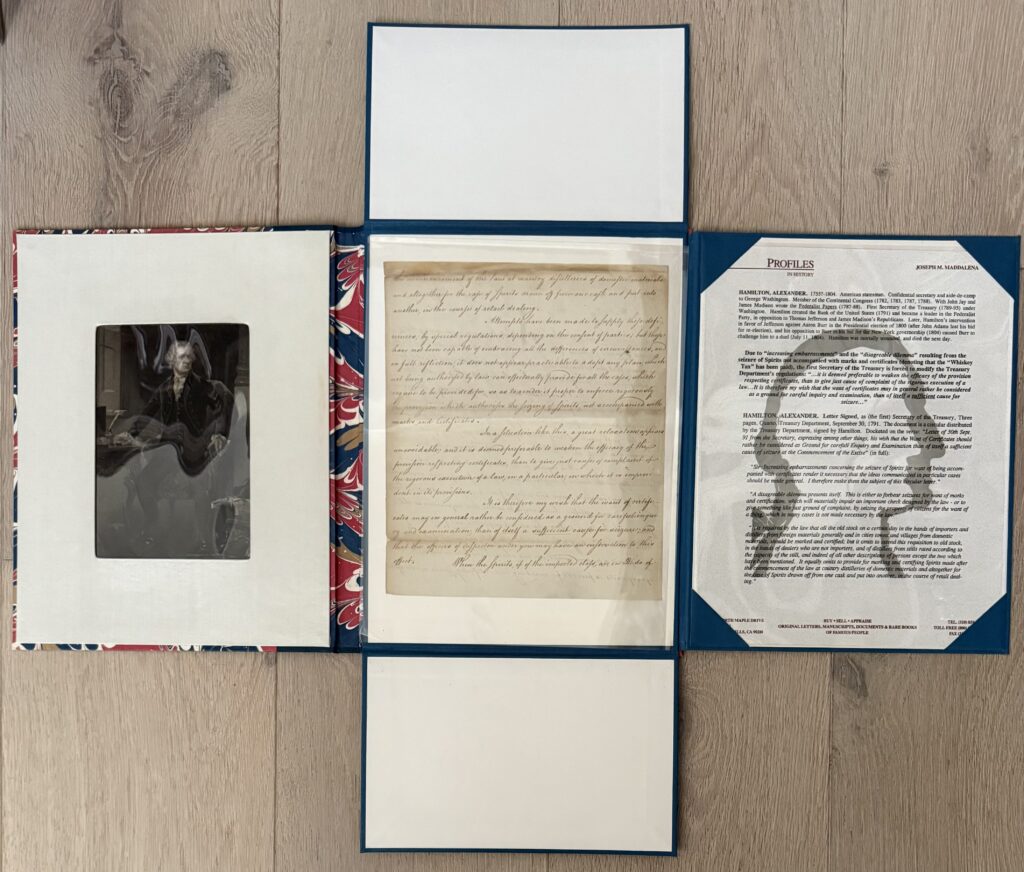

Historic New York City land deed. Two pages dated April 15, 1667 wherein the City of New York sells to Jan Smedes, “ a piece of land…located on High Street, just behind City Hall.” Smedes paid 125 Guilders in total “…done in New York on the Island of Manhattan.” Signed by Nicholas Bayard, Alderman.

Nicholas Bayard (c. 1644–1707 or 1709) was a government official and slave trader in colonial New York. Bayard served as the mayor of New York City from 1685 to 1686. He is historically most notable for being Peter Stuyvesant’s nephew and for being a prominent member of the Baynard family which remained prominent into the 20th century. Jan Smedes was born about 1640, in Ulster, New York Colony, British Colonial America and was a business man in Colonial New York.

This plot of an important parcel of land which is currently 85 Broad Street containing approximately Section 1 Lot 11 in the borough of Manhattan.

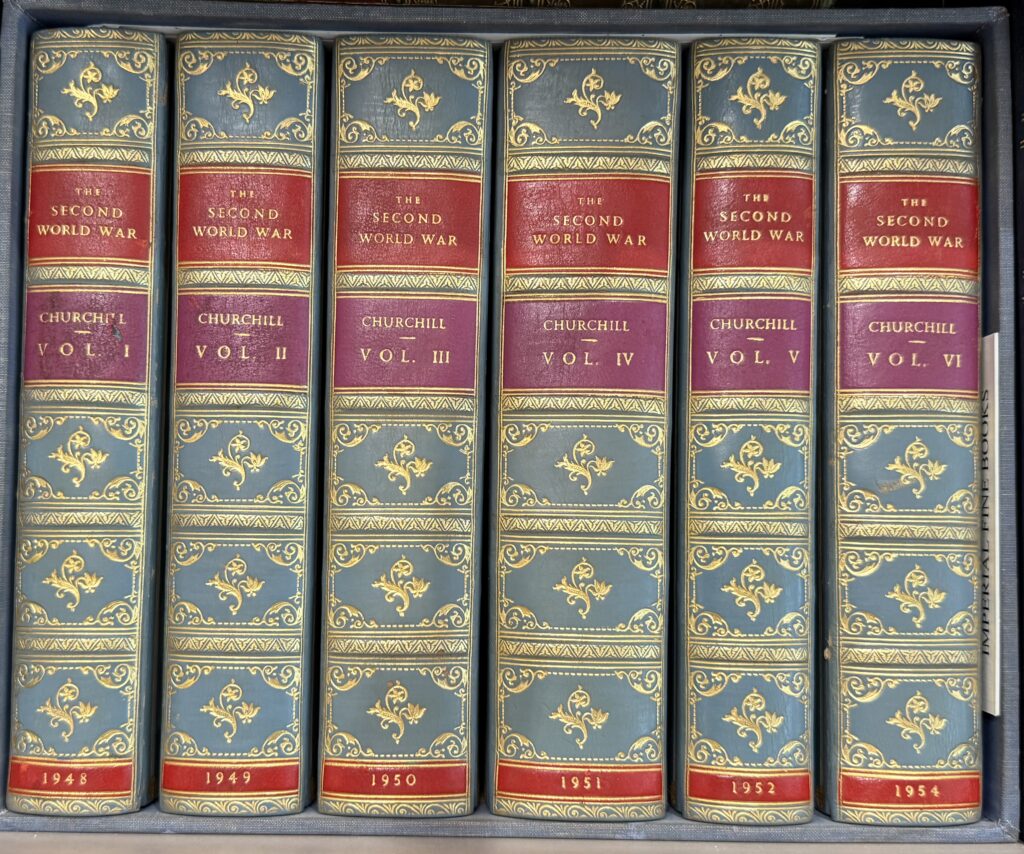

85 Broad Street in Manhattan’s financial district has a rich history, dating back to its origins as part of Dutch New Amsterdam in the 17th century. The site was home to the Stadt Huys (Town Hall) and later the Lovelace Tavern, a tavern owned by then-governor Francis Lovelace which operated from 1670 to 1706. The current building, a 30-story tower, was built in 1983 and served as the headquarters for Goldman Sachs for almost 30 years. Today, the building is home to Oppenheimer & Co., Nielsen, and Vox Media

After the city passed from Dutch to British hands in 1665, English Governor Francis Lovelace (appointed in 1668) built a tavern next door to it that would serve as an interim city hall.

Broad Street is a north–south street in the Financial District of Lower Manhattan in New York City. Originally the Broad Canal in New Amsterdam, it stretches from today’s South Street to Wall Street.

The canal drew its water from the East River, and was infilled in 1676 after numerous fruit and vegetable vendors made it difficult for boats to enter the canal.Early establishments on Broad Street in the 1600s included the Fraunces Tavern and the Royal Exchange. Later on, the area became the center of financial activity, and all smaller buildings in turn were replaced with grand banks and stock exchange buildings. Most of the structures that stand today date from the turn of the 20th century, along with more modern buildings constructed after the 1950s.

Broad Street was formerly called Heere Gracht (canal of the lords in Dutch) in old New Amsterdam. Originally an inlet from the East River, the canal was flanked by two solid ranks of three-story houses, with paths in front. Built during the administration of Peter Stuyvesant, the Broad Canal was the original Manhattan landing of the first ferry between Manhattan and Brooklyn, later the Fulton Ferry.

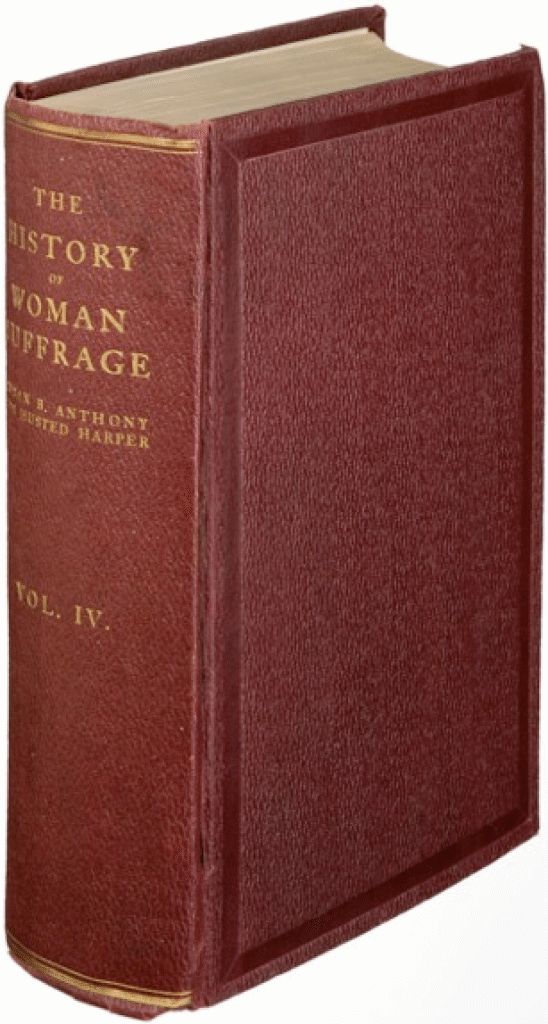

Established just three years after our deed, Lovelace Tavern, in business from 1670 to 1706 and owned by the then-New York colonial governor Colonel Francis Lovelace, occupied part of the current site of 85 Broad Street. New York Mayor Stephanus van Cortlandt built his home in 1671 on Broad Street, on the future site of Fraunces Tavern. Built as a one-story building in 1675, the Royal Exchange (later known as the Old Royal Exchange and the Merchants Exchange) was a covered marketplace located near the foot of Broad Street close to its intersection with Water Street.

The city’s first firehouse for the New York City Fire Department was built in 1736 in front of NYSE on Broad Street. Two years later, on December 16, 1737, the colony’s General Assembly created the Volunteer Fire Department of the City of New York.

The Broad Street building for the Fraunces Tavern was bought in 1762 by Samuel Fraunces, who converted the home into the popular tavern first named the Queen’s Head. Before the American Revolution, the building was one of the meeting places of the secret society, the Sons of Liberty. In 1768, the New York Chamber of Commerce was founded by a meeting in the building.

After a rebuild in 1752 that added a meeting hall on the upper story, the Royal Exchange building was the location of the Chamber of Commerce in the City of New York (later Chamber of Commerce of the State of New York) from 1770 until the Revolutionary War. The United States District Court for the District of New York was one of the original 13 courts established by the Judiciary Act of 1789, and it first sat at the Royal Exchange (Merchants Exchange) building on Broad Street.

The now-famous sculpture Charging Bull was installed on December 15, 1989 in the middle of Broad Street in front of the New York Stock Exchange as a Christmas gift to New Yorkers. After NYSE officials called police, it was later reinstalled two blocks south of the Exchange, in Bowling Green.